Fairtax has massive OTHER taxes, as you will see, and all "research" repudiated Fairtax, as explained by Boortz, rather than supports it.

200

billion in taxes on health care – including cancer taxes

___________________________________________________

There are 2.1 Trillion dollars in Fairtax projected revenue that has nothing to do with personal retail sales. That's how they get their math to add up -- these huge "other" taxes, that they try like hell to make seem like retail sales taxes.

Who really pays? These 1.5 Trillion dollars in taxes on city county and states -- who actually has to pay that?

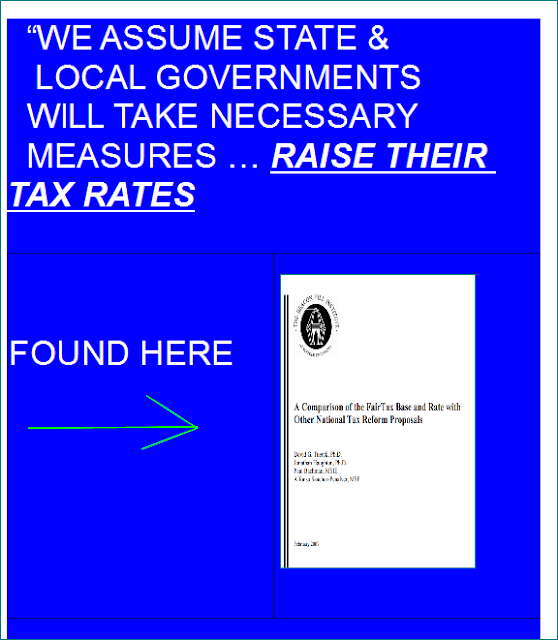

You do --Fairtax sucker, you do. Fairtax cleverly writes they "assume" wity and states will raise their tax rates appropriately.

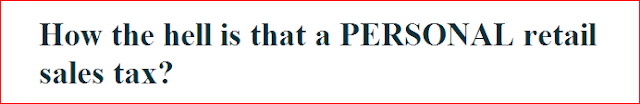

How the hell are wages paid by Dallas, and New York, and all cities, and all states, "retail sales?" Sure as hell is not retail sales. Take a look at the amounts cities would have to pay -- and remember, all cities would have to pay, and all counties too. And all states too.

No -- Fairtax was 2.1 Trillion dollars short if they only taxed possible retail sales. So they included all these other taxes to make their math add up

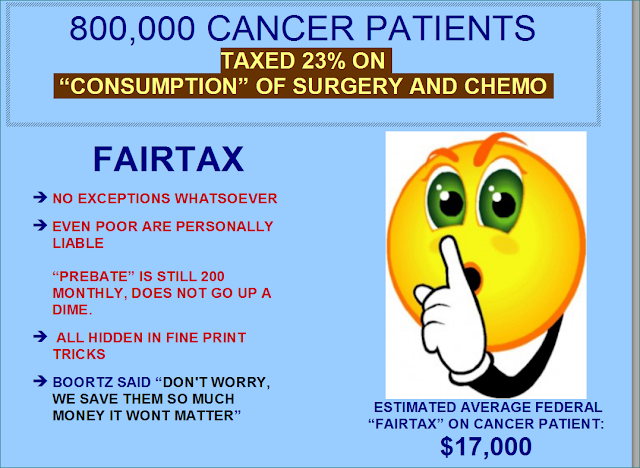

Like -- taxes on all cancer victims, without exception.

Do you think cancer victims can, should, or would pay huge fed taxes, just because they got cancer? Really?

The short answer is -Fairtax sounds great, but is going no where, because of the massive "other" taxes:

________________________________________________

The longer answer is below.

Yes, Fairtax sounds great! Fooled us too, until we read the fine print and asked questions, such as "What the hell is that tax on cities for 200 billion, doing in a footnote."

Questions like "What the hell is this huge tax on cancer patients, and nursing home residents, doing in there?"

Questions like "How the hell is life saving surgery on a child, a retail sale?"

Fairtax of course did not make these huge other taxes obvious -- Neal Boortz sure never told you about them, in his Fairtax Book. But even in the legislation, you have to read the words carefully, as President Bush Tax Panel did.

..

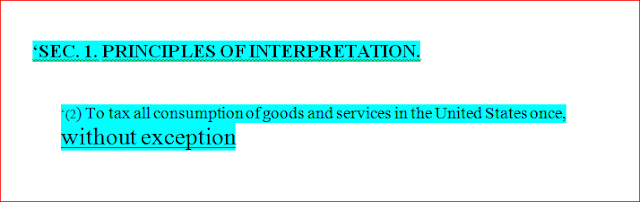

A retail sales tax on personal consumption? That's what they said for years, in a dozen books, thousands of speeches, and hundreds of videos.

WTFH?

A tax on your city for capital expenditures. A tax on your city for wages expenditures. Taxes on your city or state when they built a highway or bridge a library, a sewer system, whatever, your city would owe 23% advance tax on that.

How the hell is that a personal retail sales tax? ITS NOT.

How the hell is that even rational? And what's it doing in a footnote?

Think California would send in over 1 Billion dollars, in advance or otherwise, for their capital expenditure of the massive bridge project? Really?

So California would have to read this document by Fairtax, see that footnote, and send in over 1 Billion dollars? Because there is no where else that Fairtax hustlers mention this.

Still sound transparent to you --Boortz said the best thing about Fairtax, is how transparent it is!

Is cancer surgery a retail sale? Call it a personal retail sale if you want, call it a banana, they tax all cancer surgery "consumption".

Even a woman on medicare with breast cancer would be liable -- yes, she would -- for 40,000 dollars in fed taxes, just on her "consumption" of breast surgery goods and services. This was confirmed, reluctantly, by Neal Boortz himself, who could not weasel out of the question put to him by a very direct reporter.

We show you the fine print tricks, that cleverly says what they tax would include cancer surgery "consumed" by Medicare patients, and massive other things, in a way you may not notice. That's what we mean by fine print tricks.

President Bush Tax Advisory Panel exposed these fine print tricks -- politely, and in academic terms. In private, the Tax Panel called Fairtax a scam by "liars" but in public, they had to be polite. We won't be so polite.

The President's Tax Panel showed the fine print tricks -- 300 words, mixed in the 2 million words in Fairtax documents -- that have the massive "other taxes" . Very few words to inject 2.1 Trillion dollars into their revenue projections.

Without these 300 words, Fairtax can't inject these 2.1 Trillion dollars into their projected revenue -- or as they call it, their "tax base".

|

| FAIRTAX 300 WORDS = 2 TRILLION DOLLARS IN HIDDEN TAXES. |

The only reason Fairtax seems like it could be 23%, is that Fairtax has all these other goofy hidden taxes. And they did it, using words, written carefully.

The President's Tax Advisory Panel had no trouble spotting the fine print tricks, even though it was only 300 words out of some 2 million words. But the Tax Panel eat fine print tricks for breakfast and spit them out for lunch. The 300 words are quite noticable, when you are not fooled already into the ruse that it's a retail sales tax. There is nothing in HR25 about a simple retail sales tax to replace anything.

Cancer surgery is taxed, and the person using any cancer surgery or chemo is personally liable, even destitute cancer victims, Alzheimer patients, there are no exceptions. We show you below.

Neal Boortz reluctantly admitted all cancer patients, even the poor, are liable for the 23% tax on their "consumption" of health care services.

Fairtax tells you what they tax -- only in the fine print tricks.

Fairtax tells you what they tax -- only in the fine print tricks. Neal Boortz lied to us about what Fairtax taxes -- he "razzle dazzled" us on 65% of Fairtax revenue, because 65% of Fairtax revenue has NOTHING to do with personal consumption at "point of purchase"

Neal would throw around terms for stupid people like "point of purchase" - knowing every time he said it, that was not what Fairtax was. Did you know Boortz was paid to sell you that lie about Fairtax?

Yes, he was paid.

We have offered Neal 50,000 dollars, for years now, if he will show ANYTHING in HR25 that proves it's a personal retail sales tax. Here is why he can't do that.... Fairtax slick multi- part way of telling you what they tax. These are the most important words 15 words in that 300 word fine print trick.

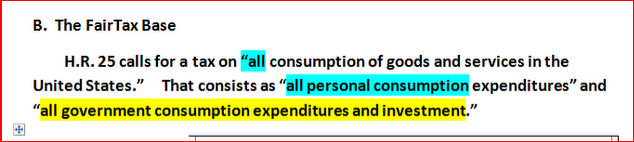

They tax all consumption. So you think that "consumption" means retail personal consumption?

Not even close. See their definition here, of "consumption".

Yes, you think "consumption" must mean personal consumption, like Boortz told you -- taxes on a toaster, on a jacket.

He never mentioned 40,000 fed tax on cancer surgery and chemo,that all cancer victims would be liable for -- no exceptions. Even Medicare patients are personally liable. That is how Fairtax math adds up, as you will see.

It's so easy to miss, because this definition is way down in the bowels of one of their documents from Beacon Hill.

Fairtax is a tax all personal consumption expenditures-- not just retail sales. Remember that.

Retail sales tax, as President Bush Tax Panel showed, only brings in, in todays dollars. 1.4Trillion. To get 3.5 Trillion in revenue, Fairtax taxes just what they say in the fine print -- "all personal consumption expenditures and government consumption expenditures.

SO they do tell you -- in a few words here and there, in what we call fine print tricks. These few dozen words are drastically different than what Fairtax hustlers like Boortz tell you, for example, in the Fairtax Books.

______________________________________________________________________

WHY CANT THEY TAX

CITY COUNTY AND STATE GOVERNMENT?

Fairtax huge taxes on city county and states is not in dispute --their spokesmen admit it, see below.

Why is that impossible to collect? Because no city would pay it. They are not told of it, for one thing. There is no way for them to know about it, it's mentioned so deceptively. Should Dallas read the fine print trick about the tax on all "government expenditures" and send in 100 million?

Really?

Even if Fairtax had made it clear, no city would pay it. The fed gov can not tax cities or counties or states. And Fairtax leaders admit it -- they say "we assume" we will be able to collect that tax. Very slick.

Fairtax put these taxes in the fine print to make their math add up. According to President Bush Tax Panel, who exposed the hustle, politely, in 2004, without these huge "other taxes" Fairtax rate would be 89%, not 23%.

Apparently, Fairtax did not want to admit a retail consumption tax would be 89%. So they included massive other taxes to make their math add up on paper.

Neal Boortz, in the Fairtax Book, made Fairtax sound almost magical -- a "very very simple" personal retail sales tax. That's what his book, speeches, videos say.

But that is not what the fine print tricks say. The actual legislation is quite different --if you read it closely.

With 100 sponsors in Congressional and all that "research" (there is no research) Fairtax should be a shoo in, at least to pass the House. But no one takes it seriously, because as great as it sounds, it's a deliberate hustle. No, it's not a great idea, with a few "flaws". You don't need to lie about 2 trillion dollars if your idea has any merit at all.

________________________________________________

But you can call it political theater if you want. Does not matter what anyone calls it, magic or a fraud.

It's the fine print that matters. In the fine print are massive "assumptions" that are goofy as hell. They might as well said they "assume" they can tax moonbeams and baby fars.

No, they didn't say they could tax moonbeams and baby farts for 2Trillion. But they did cleverly "assume" 2Trillion in other taxes -- taxes than have nothing to do with retail sales.

Fairtax claims they would be "revenue" neutral -- about 3.5 Trillion. But retail sales tax would only bring in 1.4 Trillion.

Where does the other 2.1 Trillion dollars come from? From "assumed" taxes -- not proven, not even stated clearly. Fairtax parsed words carefully -- we show you, in about 300 words, to insert 2.1 Trillion dollars in "other taxes:".

THE UNTOLD STORY OF FAIRTAX FRAUD

EXPOSED BY PRESIDENT BUSH

______________________________________________

We were fooled by Boortz because he claimed 22 million dollars in research -- a common lie by Fairtax. We believed it at first -- the more more "fine print tricks" we say, we asked to see that "research".

There is none. NONE. In fact, we have offered Boortz 50,000 cash -- he can donate it to any charity or keep it. Just show one page -- one page! -- of that "research" about Fairtax as a simple personal retail sales tax that would replace all other fed taxes.

There is no research to support Fairtax, because Fairtax is a fraud. In fact, the man Neal Boortz told us Fairtax did the "extensive research" that Fairtax was founded on, repudiated Fairtax, categorically, but politely. See below. Fairtax simply lied -- yes lied - about the research. To the extent any "research" was done, Fairtax was exposed for it's massive other taxes, so it's only partly a personal retail sales tax.

WHAT FAIRTAX TAXES

IN THE FINE PRINT

IN THE FINE PRINT

Boortz can tell you whatever he was paid to --- but here is what is in the actual legislation and fine print tricks.

They tax all consumption. So you think that "consumption" means retail personal consumption?

Not even close. See their definition here, of "consumption".

Yes, you think "consumption" must mean personal consumption, like Boortz told you -- taxes on a toaster, on a jacket.

He never mentioned 40,000 fed tax on cancer surgery and chemo,that all cancer victims would be liable for -- no exceptions. Even Medicare patients are personally liable. That is how Fairtax math adds up, as you will see.

It's so easy to miss, because this definition is way down in the bowels of one of their documents from Beacon Hill.

They tax all personal consumption expenditures-- very different animal. And they tax all government consumption expenditures -- very different animal.

That is Fairtax official definition of consumption.

WHO PAYS?

Someone pays. As Neal Boortz told us, "only people pay taxes". Neal said --ironically -- that corporate taxes are "a cruel hoax" because you pay those anyway.

The person using the goods or services pays! That's what it says! But how is your city a person, if the person pays? How is Chicago a person? How do they tax your county? Here is how- - this definition...

___________________________________________________

Apparently the same folks hired Beacon Hill to write the fine print --and in there, as President Bush Tax Panel found, are massive other taxes, that are impossible, unconstitutional, and hidden for the sole purpose of making their math add up on paper.

Neal didn't mention the 100 million dollar tax on Dallas for their wage expenditures. Nor did he mention the fact that Fairtax "assumption" is that Dallas and every city would drastically raise taxes. You have to read their fine print for that.

You can't just blame Neal. Fairtax claims a list of 80 "economists" who verified Fairtax and urged President Bush to examine it.

Or did they? We called or emailed a dozen of those "economist" who Fairtax claimed signed some letter, yet only one of them stood by Fairtax, after learning of the fine print tricks. And that guy works for Fair Tax.

In fact, the "economist" we talked to were embarrassed they had backed Fairtax at all, and had never heard of these huge taxes on cities for wages, pensions, and operational expenditures, which is unconstitutional as hell. And hidden.

As you see, in Fairtax own documents, WAY down in the fine print, they assume Los Angeles, Dallas, all cities, all counties, and all states will raise your taxes.

That's not what we said -- that's what Fairtax documents said -- waaaay down in the fine print tricks. Raise your taxes!

What the hell?

"WE WILL TAX THE UNDERGROUND ECONOMY"

Fairtax hopes we believe "illegals" and "tourist" will pay so much in "retail sales taxes" that their numbers work. That's not in their numbers, either. That's just in Neal's Book, it has no basis in fact.

It might SOUND reasonable that suddenly "illegals" will pay, but Fairtax math already included all retail sales. Retail sales do not jump 400%. Remember, retail sales are already factored in, unless "illegals" drastically increase their spending (by about 1,000%) Fairtax still does not add up.

The only way Fairtax adds up, on paper, is if they include these 2.1 trillion dollars in fine print trick taxes.

I

_______________________________________________________

HERE IS ONE OF THE FINE PRINT TRICKS, AS WE CALL THEM, EXPOSED BY PRESIDENT BUSH TAX PANEL....

But the tax on personal retail sales, that's possible, is about 1.4 Trillion. They were 2.1 Trillion dollars short. So cleverly, fraudulently in our opinion, they inserted these massive other taxes.

Dallas Texas city council, for example, would owe a 23% tax on their wage expenditures, as you will see. That would be over 100 million dollars.

Benefits are taxed too -- the "fair market value" of any benefit -- see for yourself.....

But who pays those -- really? Most of Fairtax revenue comes from these impossible taxes on city county and states. Dallas city council would owe 100 million, NYC 3Billion, but who pays that?

Neal Boortz, facing a direct question on FOX news, was asked if cancer surgery is taxed. Yes, it is. And chemo. And Alzheimer care. And nursing home care. Neal quickly changed the subject, but had to admit, yes, all cancer victims are personally liable, there are no exceptions whatsoever.

|

| DID KOCH BROTHERS FUND FAIRTAX? WE DON'T KNOW, BUT SOMEONE RICH DID. KOCHS FUNDED CATO, WHICH PUSHED FAIRTAX |

|

| GROVER NORQUIST BACKED FAIRTAX AT FIRST AFTER PRESIDENT BUSH TAX PANEL EXPOSED IT, HE BACKED OFF. |

Grover Norquest backed Fairtax, early on. Why did he suddenly back off? We don't know, but probably he read the fine print or someone told him about it.

Even Herman Cain backed off, suddenly, about the time testimony to Ways Means Committee about Fairtax fraud showed up on their web site. Herman went with the even more insane, if that's possible, 9-9-9, which had no extensive fine print anyway. It was an idea his goofy "financial" advisor dreamed up, a financial advisor that loved Fairtax.

See why President Bush Tax Panel, in private, said Fairtax folks "lie a lot"?

But if you read all their documents, word for word, definition by definition, assumption by assumption, it's there.

What about all that "research"?

|

| Dale Jorgenson politely repudiated Boortz claim of research supporting Fairtax. |

Even the guy who did the "research" -- Dale Jorgenson -- repudiated what Neal claimed, a week after the Fairtax Book came out, see below.

And Jorgenson did not okay these huge other taxes that Fairtax hid in the fine print --he was just repudiating the Boortz lie that research showed prices would fall. No such research exist, and that's not even addressing these huge hidden taxes.

Once you learn the fine print tricks,see if you agree: only hustlers or liars could or would represent this nonsense as a tax plan.

___________________________________________________

22 Million in research? Well, show it to us.

First, here is no research -- or if there is, they have never shown it. Yeah, I know, they claimed 22 million dollars in research. But they have never shown it. We have offered 50,000 dollars if they will show us one page their "research" that proves it's a personal retail sales tax.

| BEACON HILL ENTRANCE NOT RESEARCH -- THEY ARE PAID TO DO PUBLIC RELATIONS |

They show you stuff from Beacon Hill, but that is not research at all. Beacon Hill is their public relations firm, they are paid. But read their stuff closely. They are the fine print trick experts -- they won't outright lie for Fairtax. They leave that to Boortz Huckabee and others. Instead, Beacon Hill parses their words with things like "assumptions" of massive tax increases.

_____________________________________________________

So why not tell Chicago city council about it? Or Dallas? Because that would give away their fraud.

Remember, they tell you, in the fine print, that they tax whatever NIPA claims is "consumption expenditures" is taxed. So what if Neal told you it was retail sales? That's not in the fine print. In the fine print are these massive other taxes.

|

| NEAL TOLD US IT WAS "A VERY VERY SIMPLE" PERSONAL CONSUMPTION TAX. HE WAS NOT TELLING THE TRUTH. |

Fairtax refuses to show anything like this.

_______________________________________________________________________

___________________________________________________

_____________________________________________

|

KOTLIKOFF TOLD THE TRUTH, AS DECEPTIVELY AS HE COULD |

NAPA includes all military speanding!

NAPA includes all cities county and states payin 23% tax

on wage expendigures

on pension expenditures

on all capital expenditures

The fuckers at Fairtax told us it was just a very simple retail sales tax

Every fucking time Fairtax hustlers told us anything -- those fuckers knew the "NAPA TRICK"

With out the

NAPA TRICK -- THE RATE WOULD NEEDTO BE NORE LIKE 85 OR 95&

NAPA TRICK -- THE RATE WOULD NEEDTO BE NORE LIKE 85 OR 95&

Laurence J Kotlikoff wrote much of the deceptive BS in Fairtax documents for Beacon Hill. But did he lie?

Maybe not. Sure he misled, that's what he was paid to do apparently . He knew very weill Fairtax was being sold by Fairtax.org hustlers as a very simple personal retail tax! paid at the cash register!

AS DEFINED BY NAPA

✔️Kotlikoff articles tell you -- they tax all consumption as defined by NIPA.

NIPA! Neal and the other liars never mentioned that. Turns out The NIPA definition includes 23% tax on US Defense department. It includes "Four trill

✔️Kotlikoff never said it was a simple personal retail sales tax -- that was Boortz, remember?

But the same people who paid Boortz, also paid Kotlikoff. That's right, both were paid by same folks. Pretty cool trick, huh?

Kotlikoff even listed the various parts of consumption -- if you can find that document, which most people can not. And you would have to ignore everything you THOUGHT you know about Fairtax.

Is it Kotlikoff's fault you didn't find his document and read page 666 -667? It it his fault you thought Fairtax Book was on the level?

KOTLIKOFF and others told you -- cleverly, in 300 words out of 2 million words -- about these huge other taxes.

______________________________________________________

UNTAX THE POOR FRAUD....

Neal and others may tell you Fairtax completely untaxes the poor-- etc. Like this recent tweet from Fairtax.org itself. They have started lying brazeningly.

But in the legislation, there are no exceptions. So is the guy tweeting about FREE OF TAX, is of course, lying. Notice, this sweet came from some fool or hustler at Fairtax "Nation". Either he is just stupid and does not know, or he is lying and does know. Either way, Fairtax fine print is very emphatic, they tax all consumption, without exception, and their prebate is a part of the entire fraud.

The "research" Neal tries to sell as proving Fairtax, was done by Dale Jorgenson, according to Neal himself, in the Fairtax Book. Neal's slick lies in that book give the impression Harvard's Dale Jorgenson proved all these great sounding things. Nothing could be further from the truth.

_________________________________________________________________________

_________________________________________________________________________

Fairtax has massive OTHER taxes, as you will see, and all "research" repudiated Fairtax, as explained by Boortz, rather than supports it.

__

___________________________________________________

There are 2.1 Trillion dollars in Fairtax projected revenue that has nothing to do with personal retail sales. That's how they get their math to add up -- these huge "other" taxes, that they try like hell to make seem like retail sales taxes.

Who really pays? These 1.5 Trillion dollars in taxes on city county and states -- who actually has to pay that?

You do --Fairtax sucker, you do. Fairtax cleverly writes they "assume" wity and states will raise their tax rates appropriately.

How the hell are wages paid by Dallas, and New York, and all cities, and all states, "retail sales?" Sure as hell is not retail sales. Take a look at the amounts cities would have to pay -- and remember, all cities would have to pay, and all counties too. And all states too.

No -- Fairtax was 2.1 Trillion dollars short if they only taxed possible retail sales. So they included all these other taxes to make their math add up

Like -- taxes on all cancer victims, without exception.

Do you think cancer victims can, should, or would pay huge fed taxes, just because they got cancer? Really?

The short answer is -Fairtax sounds great, but is going no where, because of the massive "other" taxes:

________________________________________________

The longer answer is below.

Yes, Fairtax sounds great! Fooled us too, until we read the fine print and asked questions, such as "What the hell is that tax on cities for 200 billion, doing in a footnote."

Questions like "What the hell is this huge tax on cancer patients, and nursing home residents, doing in there?"

Questions like "How the hell is life saving surgery on a child, a retail sale?"

Fairtax of course did not make these huge other taxes obvious -- Neal Boortz sure never told you about them, in his Fairtax Book. But even in the legislation, you have to read the words carefully, as President Bush Tax Panel did.

..

A retail sales tax on personal consumption? That's what they said for years, in a dozen books, thousands of speeches, and hundreds of videos.

WTFH?

A tax on your city for capital expenditures. A tax on your city for wages expenditures. Taxes on your city or state when they built a highway or bridge a library, a sewer system, whatever, your city would owe 23% advance tax on that.

How the hell is that a personal retail sales tax? ITS NOT.

How the hell is that even rational? And what's it doing in a footnote?

Think California would send in over 1 Billion dollars, in advance or otherwise, for their capital expenditure of the massive bridge project? Really?

So California would have to read this document by Fairtax, see that footnote, and send in over 1 Billion dollars? Because there is no where else that Fairtax hustlers mention this.

Still sound transparent to you --Boortz said the best thing about Fairtax, is how transparent it is!

Is cancer surgery a retail sale? Call it a personal retail sale if you want, call it a banana, they tax all cancer surgery "consumption".

Even a woman on medicare with breast cancer would be liable -- yes, she would -- for 40,000 dollars in fed taxes, just on her "consumption" of breast surgery goods and services. This was confirmed, reluctantly, by Neal Boortz himself, who could not weasel out of the question put to him by a very direct reporter.

We show you the fine print tricks, that cleverly says what they tax would include cancer surgery "consumed" by Medicare patients, and massive other things, in a way you may not notice. That's what we mean by fine print tricks.

President Bush Tax Advisory Panel exposed these fine print tricks -- politely, and in academic terms. In private, the Tax Panel called Fairtax a scam by "liars" but in public, they had to be polite. We won't be so polite.

The President's Tax Panel showed the fine print tricks -- 300 words, mixed in the 2 million words in Fairtax documents -- that have the massive "other taxes" . Very few words to inject 2.1 Trillion dollars into their revenue projections.

Without these 300 words, Fairtax can't inject these 2.1 Trillion dollars into their projected revenue -- or as they call it, their "tax base".

The only reason Fairtax seems like it could be 23%, is that Fairtax has all these other goofy hidden taxes. And they did it, using words, written carefully.

The President's Tax Advisory Panel had no trouble spotting the fine print tricks, even though it was only 300 words out of some 2 million words. But the Tax Panel eat fine print tricks for breakfast and spit them out for lunch. The 300 words are quite noticable, when you are not fooled already into the ruse that it's a retail sales tax. There is nothing in HR25 about a simple retail sales tax to replace anything.

Cancer surgery is taxed, and the person using any cancer surgery or chemo is personally liable, even destitute cancer victims, Alzheimer patients, there are no exceptions. We show you below.

Neal Boortz reluctantly admitted all cancer patients, even the poor, are liable for the 23% tax on their "consumption" of health care services.

Fairtax tells you what they tax -- only in the fine print tricks.

Fairtax tells you what they tax -- only in the fine print tricks.

Neal Boortz lied to us about what Fairtax taxes -- he "razzle dazzled" us on 65% of Fairtax revenue, because 65% of Fairtax revenue has NOTHING to do with personal consumption at "point of purchase"

Neal would throw around terms for stupid people like "point of purchase" - knowing every time he said it, that was not what Fairtax was. Did you know Boortz was paid to sell you that lie about Fairtax?

Yes, he was paid.

We have offered Neal 50,000 dollars, for years now, if he will show ANYTHING in HR25 that proves it's a personal retail sales tax. Here is why he can't do that.... Fairtax slick multi- part way of telling you what they tax. These are the most important words 15 words in that 300 word fine print trick.

They tax all consumption. So you think that "consumption" means retail personal consumption?

Not even close. See their definition here, of "consumption".

Yes, you think "consumption" must mean personal consumption, like Boortz told you -- taxes on a toaster, on a jacket.

He never mentioned 40,000 fed tax on cancer surgery and chemo,that all cancer victims would be liable for -- no exceptions. Even Medicare patients are personally liable. That is how Fairtax math adds up, as you will see.

It's so easy to miss, because this definition is way down in the bowels of one of their documents from Beacon Hill.

Fairtax is a tax all personal consumption expenditures-- not just retail sales. Remember that.

Retail sales tax, as President Bush Tax Panel showed, only brings in, in todays dollars. 1.4Trillion. To get 3.5 Trillion in revenue, Fairtax taxes just what they say in the fine print -- "all personal consumption expenditures and government consumption expenditures.

SO they do tell you -- in a few words here and there, in what we call fine print tricks. These few dozen words are drastically different than what Fairtax hustlers like Boortz tell you, for example, in the Fairtax Books.

______________________________________________________________________

WHY CANT THEY TAX

CITY COUNTY AND STATE GOVERNMENT?

Fairtax huge taxes on city county and states is not in dispute --their spokesmen admit it, see below.

Why is that impossible to collect? Because no city would pay it. They are not told of it, for one thing. There is no way for them to know about it, it's mentioned so deceptively. Should Dallas read the fine print trick about the tax on all "government expenditures" and send in 100 million?

Really?

Even if Fairtax had made it clear, no city would pay it. The fed gov can not tax cities or counties or states. And Fairtax leaders admit it -- they say "we assume" we will be able to collect that tax. Very slick.

Fairtax put these taxes in the fine print to make their math add up. According to President Bush Tax Panel, who exposed the hustle, politely, in 2004, without these huge "other taxes" Fairtax rate would be 89%, not 23%.

Apparently, Fairtax did not want to admit a retail consumption tax would be 89%. So they included massive other taxes to make their math add up on paper.

Neal Boortz, in the Fairtax Book, made Fairtax sound almost magical -- a "very very simple" personal retail sales tax. That's what his book, speeches, videos say.

But that is not what the fine print tricks say. The actual legislation is quite different --if you read it closely.

With 100 sponsors in Congressional and all that "research" (there is no research) Fairtax should be a shoo in, at least to pass the House. But no one takes it seriously, because as great as it sounds, it's a deliberate hustle. No, it's not a great idea, with a few "flaws". You don't need to lie about 2 trillion dollars if your idea has any merit at all.

________________________________________________

But you can call it political theater if you want. Does not matter what anyone calls it, magic or a fraud.

It's the fine print that matters. In the fine print are massive "assumptions" that are goofy as hell. They might as well said they "assume" they can tax moonbeams and baby fars.

No, they didn't say they could tax moonbeams and baby farts for 2Trillion. But they did cleverly "assume" 2Trillion in other taxes -- taxes than have nothing to do with retail sales.

Fairtax claims they would be "revenue" neutral -- about 3.5 Trillion. But retail sales tax would only bring in 1.4 Trillion.

Where does the other 2.1 Trillion dollars come from? From "assumed" taxes -- not proven, not even stated clearly. Fairtax parsed words carefully -- we show you, in about 300 words, to insert 2.1 Trillion dollars in "other taxes:".

THE UNTOLD STORY OF FAIRTAX FRAUD

EXPOSED BY PRESIDENT BUSH

______________________________________________

We were fooled by Boortz because he claimed 22 million dollars in research -- a common lie by Fairtax. We believed it at first -- the more more "fine print tricks" we say, we asked to see that "research".

There is none. NONE. In fact, we have offered Boortz 50,000 cash -- he can donate it to any charity or keep it. Just show one page -- one page! -- of that "research" about Fairtax as a simple personal retail sales tax that would replace all other fed taxes.

There is no research to support Fairtax, because Fairtax is a fraud. In fact, the man Neal Boortz told us Fairtax did the "extensive research" that Fairtax was founded on, repudiated Fairtax, categorically, but politely. See below. Fairtax simply lied -- yes lied - about the research. To the extent any "research" was done, Fairtax was exposed for it's massive other taxes, so it's only partly a personal retail sales tax.

Boortz can tell you whatever he was paid to --- but here is what is in the actual legislation and fine print tricks.

They tax all consumption. So you think that "consumption" means retail personal consumption?

Not even close. See their definition here, of "consumption".

Yes, you think "consumption" must mean personal consumption, like Boortz told you -- taxes on a toaster, on a jacket.

He never mentioned 40,000 fed tax on cancer surgery and chemo,that all cancer victims would be liable for -- no exceptions. Even Medicare patients are personally liable. That is how Fairtax math adds up, as you will see.

It's so easy to miss, because this definition is way down in the bowels of one of their documents from Beacon Hill.

They tax all personal consumption expenditures-- very different animal. And they tax all government consumption expenditures -- very different animal.

That is Fairtax official definition of consumption.

Someone pays. As Neal Boortz told us, "only people pay taxes". Neal said --ironically -- that corporate taxes are "a cruel hoax" because you pay those anyway.

The person using the goods or services pays! That's what it says! But how is your city a person, if the person pays? How is Chicago a person? How do they tax your county? Here is how- - this definition...

___________________________________________________

Apparently the same folks hired Beacon Hill to write the fine print --and in there, as President Bush Tax Panel found, are massive other taxes, that are impossible, unconstitutional, and hidden for the sole purpose of making their math add up on paper.

Neal didn't mention the 100 million dollar tax on Dallas for their wage expenditures. Nor did he mention the fact that Fairtax "assumption" is that Dallas and every city would drastically raise taxes. You have to read their fine print for that.

You can't just blame Neal. Fairtax claims a list of 80 "economists" who verified Fairtax and urged President Bush to examine it.

Or did they? We called or emailed a dozen of those "economist" who Fairtax claimed signed some letter, yet only one of them stood by Fairtax, after learning of the fine print tricks. And that guy works for Fair Tax.

In fact, the "economist" we talked to were embarrassed they had backed Fairtax at all, and had never heard of these huge taxes on cities for wages, pensions, and operational expenditures, which is unconstitutional as hell. And hidden.

As you see, in Fairtax own documents, WAY down in the fine print, they assume Los Angeles, Dallas, all cities, all counties, and all states will raise your taxes.

That's not what we said -- that's what Fairtax documents said -- waaaay down in the fine print tricks. Raise your taxes!

"WE WILL TAX THE UNDERGROUND ECONOMY"

Fairtax hopes we believe "illegals" and "tourist" will pay so much in "retail sales taxes" that their numbers work. That's not in their numbers, either. That's just in Neal's Book, it has no basis in fact.

It might SOUND reasonable that suddenly "illegals" will pay, but Fairtax math already included all retail sales. Retail sales do not jump 400%. Remember, retail sales are already factored in, unless "illegals" drastically increase their spending (by about 1,000%) Fairtax still does not add up.

The only way Fairtax adds up, on paper, is if they include these 2.1 trillion dollars in fine print trick taxes.

_______________________________________________________

HERE IS ONE OF THE FINE PRINT TRICKS, AS WE CALL THEM, EXPOSED BY PRESIDENT BUSH TAX PANEL....

But the tax on personal retail sales, that's possible, is about 1.4 Trillion. They were 2.1 Trillion dollars short. So cleverly, fraudulently in our opinion, they inserted these massive other taxes.

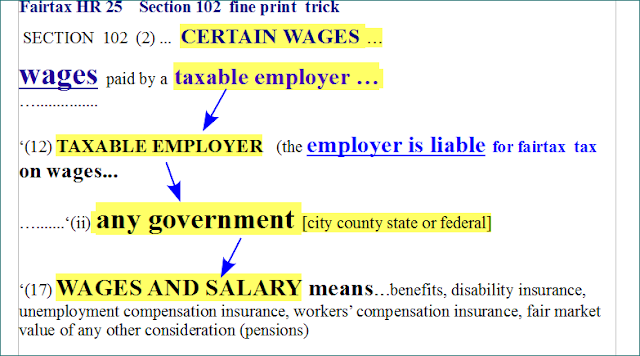

Dallas Texas city council, for example, would owe a 23% tax on their wage expenditures, as you will see. That would be over 100 million dollars.

Benefits are taxed too -- the "fair market value" of any benefit -- see for yourself.....

But who pays those -- really? Most of Fairtax revenue comes from these impossible taxes on city county and states. Dallas city council would owe 100 million, NYC 3Billion, but who pays that?

Neal Boortz, facing a direct question on FOX news, was asked if cancer surgery is taxed. Yes, it is. And chemo. And Alzheimer care. And nursing home care. Neal quickly changed the subject, but had to admit, yes, all cancer victims are personally liable, there are no exceptions whatsoever.

Grover Norquest backed Fairtax, early on. Why did he suddenly back off? We don't know, but probably he read the fine print or someone told him about it.

Even Herman Cain backed off, suddenly, about the time testimony to Ways Means Committee about Fairtax fraud showed up on their web site. Herman went with the even more insane, if that's possible, 9-9-9, which had no extensive fine print anyway. It was an idea his goofy "financial" advisor dreamed up, a financial advisor that loved Fairtax.

See why President Bush Tax Panel, in private, said Fairtax folks "lie a lot"?

But if you read all their documents, word for word, definition by definition, assumption by assumption, it's there.

What about all that "research"?

There is none. No -- none. There is literally NO research like Boortz implied, to prove anything he told you.

Even the guy who did the "research" -- Dale Jorgenson -- repudiated what Neal claimed, a week after the Fairtax Book came out, see below.

And Jorgenson did not okay these huge other taxes that Fairtax hid in the fine print --he was just repudiating the Boortz lie that research showed prices would fall. No such research exist, and that's not even addressing these huge hidden taxes.

Once you learn the fine print tricks,see if you agree: only hustlers or liars could or would represent this nonsense as a tax plan.

___________________________________________________

First, here is no research -- or if there is, they have never shown it. Yeah, I know, they claimed 22 million dollars in research. But they have never shown it. We have offered 50,000 dollars if they will show us one page their "research" that proves it's a personal retail sales tax.

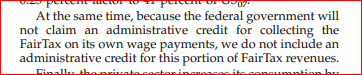

They show you stuff from Beacon Hill, but that is not research at all. Beacon Hill is their public relations firm, they are paid. But read their stuff closely. They are the fine print trick experts -- they won't outright lie for Fairtax. They leave that to Boortz Huckabee and others. Instead, Beacon Hill parses their words with things like "assumptions" of massive tax increases.

_____________________________________________________

So why not tell Chicago city council about it? Or Dallas? Because that would give away their fraud.

Remember, they tell you, in the fine print, that they tax whatever NIPA claims is "consumption expenditures" is taxed. So what if Neal told you it was retail sales? That's not in the fine print. In the fine print are these massive other taxes.

____________________________________

Fairtax refuses to show anything like this.

_______________________________________________________________________

___________________________________________________

Laurence J Kotlikoff wrote much of the deceptive BS in Fairtax documents for Beacon Hill. But did he lie?

Not really, sure he misled, that's what he was paid to do. His articles tell you -- they tax all consumption as defined by NIPA. Kotlikoff never said it was a simple personal retail sales tax -- that was Boortz, remember?

But the same people who paid Boortz, also paid Kotlikoff. That's right, both were paid by same folks. Pretty cool trick, huh?

Kotlikoff even listed the various parts of consumption -- if you can find that document, which most people can not. And you would have to ignore everything you THOUGHT you know about Fairtax.

Is it Kotlikoff's fault you didn't find his document and read page 666 -667? It it his fault you thought Fairtax Book was on the level?

KOTLIKOFF and others told you -- cleverly, in 300 words out of 2 million words -- about these huge other taxes.

______________________________________________________

UNTAX THE POOR FRAUD....

Neal and others may tell you Fairtax completely untaxes the poor-- etc. Like this recent tweet from Fairtax.org itself. They have started lying brazeningly.

But in the legislation, there are no exceptions. So is the guy tweeting about FREE OF TAX, is of course, lying. Notice, this sweet came from some fool or hustler at Fairtax "Nation". Either he is just stupid and does not know, or he is lying and does know. Either way, Fairtax fine print is very emphatic, they tax all consumption, without exception, and their prebate is a part of the entire fraud.

The "research" Neal tries to sell as proving Fairtax, was done by Dale Jorgenson, according to Neal himself, in the Fairtax Book. Neal's slick lies in that book give the impression Harvard's Dale Jorgenson proved all these great sounding things. Nothing could be further from the truth.

_________________________________________________________________________

_________________________________________________________________________

Does Fairtax really believe New York City (and every city) will pay massive taxes on their wage, pension, and operational expenditures? No, of course not. They aren't stupid.

So why does Fairtax have huge impossible and unconstitutional taxes hidden in the fine print?

To make their math add up. Every lie, every footnote trick, every 5 part deceptive definition, every goofy "assumption" in Fairtax documents you will never see, is to make their math add up.

_________________________________

Fairtax spokesmen Neal Boortz had to admit it, on FOX news. A reporter asked him if even the poor are liable for "cancer taxes". Neal said yes, but added quickly "don't worry, we will save her (cancer victim) so much, it won't matter".

You actually need to find out what Fairtax calls "NIPA" definitions in this document. Oh, you never saw it? They hoped you wouldn't see it.

President Bush Tax Advisory Panel showed this clever hustle -- it was not that hard, they just had to read all of the documents, closely. Every footnote.

Like footnote 19, about massive advance taxes every city county and state would have to pay -- in advance. See footnote 19, its one of the clever deception tricks in Fairtax. Put there by lying bastards to fool you. Not to inform you.

It does not matter if Neal told you it was a retail sales tax, if Huckabee told you it was just a simple tax at the store, whatever anyone told you, does not matter.

It's the fine print in the legislation and supporting documents that matter.

_______________________________________

Yes, a 40,000 fed tax on your cancer surgery and chemo will matter. And anyway, why should cancer victims pay huge fed taxes? Just because they got sick?

Cancer victims should NOT be taxed 40,000 dollars, just because they got sick.

So why does Fairtax have these massive other taxes -- like the cancer tax?

To make their math add up, that's why.

_________________________________

Better read the fine print -- especially when they promise so much, for so little.

______________________________________

Do you really think cancer victims on Medicare can, should, and will pay 39,000 extra in fed taxes, just because they got sick? And only because of some fine print tricks written in double talk by lying bastards?

Do you really think cancer victims on Medicare can, should, and will pay 39,000 extra in fed taxes, just because they got sick? And only because of some fine print tricks written in double talk by lying bastards?

How can medicare patients be taxed, in the legislation? It does not say that clearly -- so where is it?

That's how fine print tricks work. They say it - -but deliberately make it deceptive. Here are the parts that would tax all medicare patients on all health care benefits, including cancer surgery:

While the HUSTLE says they tax personal retail sales -- the actual legislation says they tax what NIPA defines as "personal consumption and government consumption expenditures."

Cancer surgery is in NIPA definitions of personal consumption.

_________________________________________________________________________

NOT IN DISPUTE

These huge wage and expenditures taxes on all city county and states, and the huge taxes on all cancer victims, are NOT in dispute. Fairtax leaders, when questioned in a way they can't wiggle out, admit these taxes are there (see more below).

Even when they admit these huge wage, pension, operational expenditure taxes-- they simply refuse to give any further information about it. For example, if a medicare patient with breast cancer has 170,000 in "consumption" of surgery and chemo - how much is she liable? The math shows it would be 39,000 dollars.

Fairtax won't tell you how she would pay.

It's bad enough (fraudulent enough) that Fairtax didn't tell us about these huge other taxes at the start. But when you discover them in the fine print tricks, they still refuse to explain them.

That's exactly what fraudulent about Fairtax. It's not a well intentioned plan with a few "kinks" that need to be "fixed". It's a fraud because the vast majority of tax revenue is impossible BS and they know it.

Regarding the tax on cancer victims who are poor, Neal Boortz on FOX news, just said "Oh that doesn't matter, we will save her that much". Really? They will save the medicare patient with breast cancer 39,000 dollars so she can pay a tax Fairtax hid in the fine print?

All personal and government consumption, including capital expenditures, wages, pensions, operational costs -- are of course DRASTICALLY larger than retail sales alone.

President Bush Tax Advisory Panel told the public about the hustle -- in very polite terms, publically. National Review exposed it more bluntly -- at the bottom of this entry, we will paste Bruce Barlett's 2004 article in NRO.

I private, William Gale, head of the Tax Panel that unraveled the fine print tricks, said Fairtax spokesmen "Lie a lot". Indeed -- they did and do.

___________________________________________________

President Bush Tax Advisory Panel did not have that hard of a job to do to expose the fraud. They simply read the fine print. We show you the fine print.

Without exception. That means your cancer surgery is taxed, without exception. No, remember, it does not matter who actually paid for the cancer surgery -- read it closely. The person "using or consuming" the goods or services is liable.

Without exception.

So Boortz may tell you they "completely untax the poor" -- but that's a lie, a fraud, and Neal was paid to give out those lies. Yes, he was paid, and yes he was lying.

Nothing in HR25 exempts the poor, quite the opposite in fact.

You have to ignore the hustle -- the book, the speeches, the videos. Those are all part of the hustle -- and none of them are true factually, none of them have a true narrative either.

The Tax Panel didn't give a shit what Neal Boortz put in his fraudulent book -- it didn't matter. They didn't give a shit what Fairtax hustlers said in the books,videos and speeches.

President Bush Tax Panel just had to read the various Fairtax documents were this fraud is hidden -- in clever fine print tricks.

This is not even a full listing of the family's "consumption" expenditure. It's actually worse.

And yes, a family of four would be taxed on cancer treatment "consumption" without exception. The dorm costs, same thing.

They would not be taxed on "tuition" consumption, but would be taxed on dorm "consumption" -- again, no exception. The person using or consuming the goods or services are liable, without exception.

Some people would owe 1000% fed tax rate --an absurdity -- if they used or consumed a lot of "goods or services" but had modest income.

Does Fairtax really believe people with breast cancer will can or should pay 40K extra in fed tax, without exception? No -- of course not. They aren't stupid, they are deceptive. Big difference.

If they were stupid they would be honest in the find print, and honest in their books videos and speeches. But they are deceptive because they hide the goofy parts -- such as the tax on all cancer victims.

People on Medicare, the poor, are prime examples. No, Fairtax leaders do NOT expect them to pay taxes. But if they exempt cancer surgery, they would expose their own fraud -- that all health care is taxed. If you know all health care is taxed, without exception, you would figure out how goofy it is.

But even people with health insurance, would personally owe the fed tax on their "consumption" of health care. So if your dad had heart surgery, if your mom had hip surgery, and insurance paid most of the bill -- your mom or dad would owe 30-60K in fed taxes, ON TOP of all other fed taxes in Fairtax.

But the cancer taxes are nothing compared to the huge (1.5 Trillion dollar huge) tax on state and local government. Fairtax defines person as many things, one of the words in the definition is "government".

Did you know your city would have to pay a 4 million dollar tax on the "operational" expenditures of 13 million? Chicago would have to pay over 40 million dollar wage, pension, and expenditure tax, just on their library system.

Dallas would owe over 100 million dollar tax just on wage expenditures! But New York City would get the biggest surprise, a 4B dollar wage pension and operational expenditure tax.

Thes wage and pension expenditure taxes are goofy as hell, unconstitutional as hell, and Fairtax hustlers know it. That's why they hid it in the fine print.

Neal Boortz told his suckers at least 1000 times that Fairtax was "transparent". Simple and "transparent". ''

Even Fairtax own "researcher," Dale Jorgenson, the guy Boortz claimed did the "extensive research" to prove the hustle in Neal's book, essentially refuted every basic claim in Fairtax, in an interview on CNN.

If Fairtax were "transparent" as Neal Boortz claimed, all cities would know that. All cancer victims would know that.

Fairtax actively and purposely hid these goofy impossible parts of the plan in "fine print tricks" we show you.

_________________________________________________

Only a small part of it is a personal retail sales tax.

_________________________________________________

Welcome to the world of Fairtax Fine Print Tricks.

This tricky definition of consumption is quite massive -- it includes all cancer surgery, because it includes EVERYTHING consumed or expended by "natural persons" or city county and states into a "tax base" Then it "removes" a few things - like education expenditures-- from the base.

But everything is in the tax base (including wages pensions) unless it is removed. Very slick.

TAX BASE TRICKS

Whatever is "in the tax base" they tax. Cancer consumption is in the tax base.

All wages and pensions and "fairmarket value" of all military pay, pensions, and benefits, are in the tax base.

Dallas Texas city wages, pensions and benefits -- are in the tax base. Your city county and state wages pensions and benefits and operational expenditures -- are in the tax base.

That means -- by definition -- Fairtax taxes them.

__________________________________

All health care is taxed -- and "the person using or consuming" the goods or services is liable -- without exception. See below.

All health care is taxed -- and "the person using or consuming" the goods or services is liable -- without exception. See below.

Did you know Fairtax taxes most city county and state wages and pensions in the USA?

Even military pay and pensions are taxed.

Did you know that or not? No, the employee does not pay it, the city county state or fed gov pays it.

Wages and salaries and pension "expenditures" taxed. You can't get that from reading just one of the definitions -- you have to read them all, and put them together. That was no trouble for President Bush Tax Advisory Panel, who exposed this in 2004.

______________________________________________

And guess where you find it? In the footnotes, fine print, and definition tricks, in Fairtax hustle.

No, the person, the soldier, or cop, or firemen, don't pay that tax. The "employer" has to pay it.

Dallas, for example, would have to pay 23% tax on all wages and pensions it pays it's police and firemen. All such wages pensions and "fair market value" of all benefits whatsoever, are taxed.

It's in the fine print. But it's only in the fine print in very clever and deceptive ways. By the way -- Fairtax fine print cleverly says "we assume" cities counties and states will "increase their tax rates appropriately"

Yeah -- increase all city taxes, appropriately. Increase all county taxes, appropriately, increase all state taxes, appropriately. That's not what we say-- that's what in Fairtax document fine print.

__________________________________________________

But Fairtax is a PERSONAL consumption tax? Right? I mean they say that, Neal Boortz said it's a "very very simple" personal retail sales tax. Very simple.

Mike Rawlings Mayor of Dallas, would be a tad bit surprised if suddenly his city had to pay 100 million or more in "wage expenditure" taxes. Why would Mike be surprised -- because he, and every other mayor, every other county official, every other state official, was never told about it.

It's only in the cleverly scattered fine print tricks: like defining all cities as a person.

So when Boortz tells you its a "simple PERSONAL retail sales tax" that's only true if definitions are reversed somewhere - and we show you the tricky - dicky definition below.

Yes, in a sub subparagrph, in a list of boring definitions, they insert one word -- in a series of words -- to define a person as "any government".

Fairtax officials David Kendall, James Bennett, and Fairtax blogger Ross Calloway, admit, even brag, that this definition -- is Section 2a, subsection 7, is their "legal basis" for the tax on every city and every county in the USA.

First, we found out, there is no research to support anything Boortz claimed. Yes, there have been scholarly reports -- all of them show Fairtax has massive other taxes, not just personal retail sales taxes.

We offered 50,000 dollars (seriously) if Neal could show any research whatsoever that proved Fairtax was a simple personal consumption tax, as he claimed. He could donate that to charity, or keep it.

Why not show that research he talked about? Even without a 50K offer, why not show it?

But especially with a 50K offer -- why not show it? Amazing. They don't have to show the research is fool proof, just that real research took place, that is factually about a personal retail sales tax of 23% that would replace all other fed taxes.

Remember, Neal claimed it was valid because of the research- who why not show it?

We are still waiting.

But the same people who paid Boortz, also paid Kotlikoff. That's right, both were paid by same folks. Pretty cool trick, huh?

Kotlikoff even listed the various parts of consumption -- if you can find that document, which most people can not. And you would have to ignore everything you THOUGHT you know about Fairtax.

Is it Kotlikoff's fault you didn't find his document and read page 666 -667? It it his fault you thought Fairtax Book was on the level?

KOTLIKOFF and others told you -- cleverly, in 300 words out of 2 million words -- about these huge other taxes.

______________________________________________________

UNTAX THE POOR FRAUD....

Neal and others may tell you Fairtax completely untaxes the poor-- etc. Like this recent tweet from Fairtax.org itself. They have started lying brazeningly.

But in the legislation, there are no exceptions. So is the guy tweeting about FREE OF TAX, is of course, lying. Notice, this sweet came from some fool or hustler at Fairtax "Nation". Either he is just stupid and does not know, or he is lying and does know. Either way, Fairtax fine print is very emphatic, they tax all consumption, without exception, and their prebate is a part of the entire fraud.

The "research" Neal tries to sell as proving Fairtax, was done by Dale Jorgenson, according to Neal himself, in the Fairtax Book. Neal's slick lies in that book give the impression Harvard's Dale Jorgenson proved all these great sounding things. Nothing could be further from the truth.

|

| BOTH PAID TO MISLEAD PEOPLE ABOUT FAIRTAX WHO PAID THEM? WE DONT KNOW. |

_________________________________________________________________________

Answers:

1) C. The breast cancer victim would owe 46,000 dollars as fairtax fed tax, just on the "consumption" of medical goods and services. Yes, it's impossible for a destitute woman to pay 46K in fed taxes. Fairtax knows that. But they needed their math to add up.

2) C. Dallas would owe 70 million dollars as fed "Fairtax." Actual numbers would be twice that, because the numbers in the example were very conservative. And Dallas, per Fairtax fine print tricks, would or should "raise their tax rates" appropriately.

_________________________________________________________________________

Fairtax has massive OTHER taxes, as you will see, and all "research" repudiated Fairtax, as explained by Boortz, rather than supports it.

___________________________________________________

There are 2.1 Trillion dollars in Fairtax projected revenue that has nothing to do with personal retail sales. That's how they get their math to add up -- these huge "other" taxes, that they try like hell to make seem like retail sales taxes.

Who really pays? These 1.5 Trillion dollars in taxes on city county and states -- who actually has to pay that?

You do --Fairtax sucker, you do. Fairtax cleverly writes they "assume" wity and states will raise their tax rates appropriately.

How the hell are wages paid by Dallas, and New York, and all cities, and all states, "retail sales?" Sure as hell is not retail sales. Take a look at the amounts cities would have to pay -- and remember, all cities would have to pay, and all counties too. And all states too.

No -- Fairtax was 2.1 Trillion dollars short if they only taxed possible retail sales. So they included all these other taxes to make their math add up

Like -- taxes on all cancer victims, without exception.

Do you think cancer victims can, should, or would pay huge fed taxes, just because they got cancer? Really?

The short answer is -Fairtax sounds great, but is going no where, because of the massive "other" taxes:

________________________________________________

The longer answer is below.

Yes, Fairtax sounds great! Fooled us too, until we read the fine print and asked questions, such as "What the hell is that tax on cities for 200 billion, doing in a footnote."

Questions like "What the hell is this huge tax on cancer patients, and nursing home residents, doing in there?"

Questions like "How the hell is life saving surgery on a child, a retail sale?"

Fairtax of course did not make these huge other taxes obvious -- Neal Boortz sure never told you about them, in his Fairtax Book. But even in the legislation, you have to read the words carefully, as President Bush Tax Panel did.

..

A retail sales tax on personal consumption? That's what they said for years, in a dozen books, thousands of speeches, and hundreds of videos.

WTFH?

A tax on your city for capital expenditures. A tax on your city for wages expenditures. Taxes on your city or state when they built a highway or bridge a library, a sewer system, whatever, your city would owe 23% advance tax on that.

How the hell is that a personal retail sales tax? ITS NOT.

How the hell is that even rational? And what's it doing in a footnote?

Think California would send in over 1 Billion dollars, in advance or otherwise, for their capital expenditure of the massive bridge project? Really?

So California would have to read this document by Fairtax, see that footnote, and send in over 1 Billion dollars? Because there is no where else that Fairtax hustlers mention this.

Still sound transparent to you --Boortz said the best thing about Fairtax, is how transparent it is!

Is cancer surgery a retail sale? Call it a personal retail sale if you want, call it a banana, they tax all cancer surgery "consumption".

Even a woman on medicare with breast cancer would be liable -- yes, she would -- for 40,000 dollars in fed taxes, just on her "consumption" of breast surgery goods and services. This was confirmed, reluctantly, by Neal Boortz himself, who could not weasel out of the question put to him by a very direct reporter.

We show you the fine print tricks, that cleverly says what they tax would include cancer surgery "consumed" by Medicare patients, and massive other things, in a way you may not notice. That's what we mean by fine print tricks.

President Bush Tax Advisory Panel exposed these fine print tricks -- politely, and in academic terms. In private, the Tax Panel called Fairtax a scam by "liars" but in public, they had to be polite. We won't be so polite.

The President's Tax Panel showed the fine print tricks -- 300 words, mixed in the 2 million words in Fairtax documents -- that have the massive "other taxes" . Very few words to inject 2.1 Trillion dollars into their revenue projections.

Without these 300 words, Fairtax can't inject these 2.1 Trillion dollars into their projected revenue -- or as they call it, their "tax base".

|

| FAIRTAX 300 WORDS = 2 TRILLION DOLLARS IN HIDDEN TAXES. |

The only reason Fairtax seems like it could be 23%, is that Fairtax has all these other goofy hidden taxes. And they did it, using words, written carefully.

The President's Tax Advisory Panel had no trouble spotting the fine print tricks, even though it was only 300 words out of some 2 million words. But the Tax Panel eat fine print tricks for breakfast and spit them out for lunch. The 300 words are quite noticable, when you are not fooled already into the ruse that it's a retail sales tax. There is nothing in HR25 about a simple retail sales tax to replace anything.

Cancer surgery is taxed, and the person using any cancer surgery or chemo is personally liable, even destitute cancer victims, Alzheimer patients, there are no exceptions. We show you below.

Neal Boortz reluctantly admitted all cancer patients, even the poor, are liable for the 23% tax on their "consumption" of health care services.

Fairtax tells you what they tax -- only in the fine print tricks.

Fairtax tells you what they tax -- only in the fine print tricks. Neal Boortz lied to us about what Fairtax taxes -- he "razzle dazzled" us on 65% of Fairtax revenue, because 65% of Fairtax revenue has NOTHING to do with personal consumption at "point of purchase"

Neal would throw around terms for stupid people like "point of purchase" - knowing every time he said it, that was not what Fairtax was. Did you know Boortz was paid to sell you that lie about Fairtax?

Yes, he was paid.

We have offered Neal 50,000 dollars, for years now, if he will show ANYTHING in HR25 that proves it's a personal retail sales tax. Here is why he can't do that.... Fairtax slick multi- part way of telling you what they tax. These are the most important words 15 words in that 300 word fine print trick.

They tax all consumption. So you think that "consumption" means retail personal consumption?

Not even close. See their definition here, of "consumption".

Yes, you think "consumption" must mean personal consumption, like Boortz told you -- taxes on a toaster, on a jacket.

He never mentioned 40,000 fed tax on cancer surgery and chemo,that all cancer victims would be liable for -- no exceptions. Even Medicare patients are personally liable. That is how Fairtax math adds up, as you will see.

It's so easy to miss, because this definition is way down in the bowels of one of their documents from Beacon Hill.

Fairtax is a tax all personal consumption expenditures-- not just retail sales. Remember that.

Retail sales tax, as President Bush Tax Panel showed, only brings in, in todays dollars. 1.4Trillion. To get 3.5 Trillion in revenue, Fairtax taxes just what they say in the fine print -- "all personal consumption expenditures and government consumption expenditures.

SO they do tell you -- in a few words here and there, in what we call fine print tricks. These few dozen words are drastically different than what Fairtax hustlers like Boortz tell you, for example, in the Fairtax Books.

______________________________________________________________________

WHY CANT THEY TAX

CITY COUNTY AND STATE GOVERNMENT?

Fairtax huge taxes on city county and states is not in dispute --their spokesmen admit it, see below.

Why is that impossible to collect? Because no city would pay it. They are not told of it, for one thing. There is no way for them to know about it, it's mentioned so deceptively. Should Dallas read the fine print trick about the tax on all "government expenditures" and send in 100 million?

Really?

Even if Fairtax had made it clear, no city would pay it. The fed gov can not tax cities or counties or states. And Fairtax leaders admit it -- they say "we assume" we will be able to collect that tax. Very slick.

Fairtax put these taxes in the fine print to make their math add up. According to President Bush Tax Panel, who exposed the hustle, politely, in 2004, without these huge "other taxes" Fairtax rate would be 89%, not 23%.

Apparently, Fairtax did not want to admit a retail consumption tax would be 89%. So they included massive other taxes to make their math add up on paper.

Neal Boortz, in the Fairtax Book, made Fairtax sound almost magical -- a "very very simple" personal retail sales tax. That's what his book, speeches, videos say.

But that is not what the fine print tricks say. The actual legislation is quite different --if you read it closely.

With 100 sponsors in Congressional and all that "research" (there is no research) Fairtax should be a shoo in, at least to pass the House. But no one takes it seriously, because as great as it sounds, it's a deliberate hustle. No, it's not a great idea, with a few "flaws". You don't need to lie about 2 trillion dollars if your idea has any merit at all.

________________________________________________

But you can call it political theater if you want. Does not matter what anyone calls it, magic or a fraud.

It's the fine print that matters. In the fine print are massive "assumptions" that are goofy as hell. They might as well said they "assume" they can tax moonbeams and baby fars.

No, they didn't say they could tax moonbeams and baby farts for 2Trillion. But they did cleverly "assume" 2Trillion in other taxes -- taxes than have nothing to do with retail sales.

Fairtax claims they would be "revenue" neutral -- about 3.5 Trillion. But retail sales tax would only bring in 1.4 Trillion.

Where does the other 2.1 Trillion dollars come from? From "assumed" taxes -- not proven, not even stated clearly. Fairtax parsed words carefully -- we show you, in about 300 words, to insert 2.1 Trillion dollars in "other taxes:".

THE UNTOLD STORY OF FAIRTAX FRAUD

EXPOSED BY PRESIDENT BUSH

______________________________________________

We were fooled by Boortz because he claimed 22 million dollars in research -- a common lie by Fairtax. We believed it at first -- the more more "fine print tricks" we say, we asked to see that "research".

There is none. NONE. In fact, we have offered Boortz 50,000 cash -- he can donate it to any charity or keep it. Just show one page -- one page! -- of that "research" about Fairtax as a simple personal retail sales tax that would replace all other fed taxes.

There is no research to support Fairtax, because Fairtax is a fraud. In fact, the man Neal Boortz told us Fairtax did the "extensive research" that Fairtax was founded on, repudiated Fairtax, categorically, but politely. See below. Fairtax simply lied -- yes lied - about the research. To the extent any "research" was done, Fairtax was exposed for it's massive other taxes, so it's only partly a personal retail sales tax.

WHAT FAIRTAX TAXES

IN THE FINE PRINT

IN THE FINE PRINT

Boortz can tell you whatever he was paid to --- but here is what is in the actual legislation and fine print tricks.

They tax all consumption. So you think that "consumption" means retail personal consumption?

Not even close. See their definition here, of "consumption".

Yes, you think "consumption" must mean personal consumption, like Boortz told you -- taxes on a toaster, on a jacket.

He never mentioned 40,000 fed tax on cancer surgery and chemo,that all cancer victims would be liable for -- no exceptions. Even Medicare patients are personally liable. That is how Fairtax math adds up, as you will see.

It's so easy to miss, because this definition is way down in the bowels of one of their documents from Beacon Hill.

They tax all personal consumption expenditures-- very different animal. And they tax all government consumption expenditures -- very different animal.

That is Fairtax official definition of consumption.

WHO PAYS?

Someone pays. As Neal Boortz told us, "only people pay taxes". Neal said --ironically -- that corporate taxes are "a cruel hoax" because you pay those anyway.

The person using the goods or services pays! That's what it says! But how is your city a person, if the person pays? How is Chicago a person? How do they tax your county? Here is how- - this definition...

___________________________________________________

Apparently the same folks hired Beacon Hill to write the fine print --and in there, as President Bush Tax Panel found, are massive other taxes, that are impossible, unconstitutional, and hidden for the sole purpose of making their math add up on paper.

Neal didn't mention the 100 million dollar tax on Dallas for their wage expenditures. Nor did he mention the fact that Fairtax "assumption" is that Dallas and every city would drastically raise taxes. You have to read their fine print for that.

You can't just blame Neal. Fairtax claims a list of 80 "economists" who verified Fairtax and urged President Bush to examine it.

Or did they? We called or emailed a dozen of those "economist" who Fairtax claimed signed some letter, yet only one of them stood by Fairtax, after learning of the fine print tricks. And that guy works for Fair Tax.

In fact, the "economist" we talked to were embarrassed they had backed Fairtax at all, and had never heard of these huge taxes on cities for wages, pensions, and operational expenditures, which is unconstitutional as hell. And hidden.

As you see, in Fairtax own documents, WAY down in the fine print, they assume Los Angeles, Dallas, all cities, all counties, and all states will raise your taxes.

That's not what we said -- that's what Fairtax documents said -- waaaay down in the fine print tricks. Raise your taxes!

What the hell?

"WE WILL TAX THE UNDERGROUND ECONOMY"

Fairtax hopes we believe "illegals" and "tourist" will pay so much in "retail sales taxes" that their numbers work. That's not in their numbers, either. That's just in Neal's Book, it has no basis in fact.

It might SOUND reasonable that suddenly "illegals" will pay, but Fairtax math already included all retail sales. Retail sales do not jump 400%. Remember, retail sales are already factored in, unless "illegals" drastically increase their spending (by about 1,000%) Fairtax still does not add up.

The only way Fairtax adds up, on paper, is if they include these 2.1 trillion dollars in fine print trick taxes.

I

_______________________________________________________

HERE IS ONE OF THE FINE PRINT TRICKS, AS WE CALL THEM, EXPOSED BY PRESIDENT BUSH TAX PANEL....

But the tax on personal retail sales, that's possible, is about 1.4 Trillion. They were 2.1 Trillion dollars short. So cleverly, fraudulently in our opinion, they inserted these massive other taxes.

Dallas Texas city council, for example, would owe a 23% tax on their wage expenditures, as you will see. That would be over 100 million dollars.

Benefits are taxed too -- the "fair market value" of any benefit -- see for yourself.....

But who pays those -- really? Most of Fairtax revenue comes from these impossible taxes on city county and states. Dallas city council would owe 100 million, NYC 3Billion, but who pays that?

Neal Boortz, facing a direct question on FOX news, was asked if cancer surgery is taxed. Yes, it is. And chemo. And Alzheimer care. And nursing home care. Neal quickly changed the subject, but had to admit, yes, all cancer victims are personally liable, there are no exceptions whatsoever.

|

| DID KOCH BROTHERS FUND FAIRTAX? WE DON'T KNOW, BUT SOMEONE RICH DID. KOCHS FUNDED CATO, WHICH PUSHED FAIRTAX |

|

| GROVER NORQUIST BACKED FAIRTAX AT FIRST AFTER PRESIDENT BUSH TAX PANEL EXPOSED IT, HE BACKED OFF. |

Grover Norquest backed Fairtax, early on. Why did he suddenly back off? We don't know, but probably he read the fine print or someone told him about it.

Even Herman Cain backed off, suddenly, about the time testimony to Ways Means Committee about Fairtax fraud showed up on their web site. Herman went with the even more insane, if that's possible, 9-9-9, which had no extensive fine print anyway. It was an idea his goofy "financial" advisor dreamed up, a financial advisor that loved Fairtax.

See why President Bush Tax Panel, in private, said Fairtax folks "lie a lot"?

But if you read all their documents, word for word, definition by definition, assumption by assumption, it's there.

What about all that "research"?

|

| Dale Jorgenson politely repudiated Boortz claim of research supporting Fairtax. |

Even the guy who did the "research" -- Dale Jorgenson -- repudiated what Neal claimed, a week after the Fairtax Book came out, see below.

And Jorgenson did not okay these huge other taxes that Fairtax hid in the fine print --he was just repudiating the Boortz lie that research showed prices would fall. No such research exist, and that's not even addressing these huge hidden taxes.

Once you learn the fine print tricks,see if you agree: only hustlers or liars could or would represent this nonsense as a tax plan.

___________________________________________________

22 Million in research? Well, show it to us.

First, here is no research -- or if there is, they have never shown it. Yeah, I know, they claimed 22 million dollars in research. But they have never shown it. We have offered 50,000 dollars if they will show us one page their "research" that proves it's a personal retail sales tax.

| BEACON HILL ENTRANCE NOT RESEARCH -- THEY ARE PAID TO DO PUBLIC RELATIONS |

They show you stuff from Beacon Hill, but that is not research at all. Beacon Hill is their public relations firm, they are paid. But read their stuff closely. They are the fine print trick experts -- they won't outright lie for Fairtax. They leave that to Boortz Huckabee and others. Instead, Beacon Hill parses their words with things like "assumptions" of massive tax increases.

_____________________________________________________

So why not tell Chicago city council about it? Or Dallas? Because that would give away their fraud.

Remember, they tell you, in the fine print, that they tax whatever NIPA claims is "consumption expenditures" is taxed. So what if Neal told you it was retail sales? That's not in the fine print. In the fine print are these massive other taxes.

|

| NEAL TOLD US IT WAS "A VERY VERY SIMPLE" PERSONAL CONSUMPTION TAX. HE WAS NOT TELLING THE TRUTH. |

Fairtax refuses to show anything like this.

_______________________________________________________________________

___________________________________________________

_____________________________________________

|

| KOTLIKOFF TOLD THE TRUTH, AS DECEPTIVELY AS HE COULD |

Laurence J Kotlikoff wrote much of the deceptive BS in Fairtax documents for Beacon Hill. But did he lie?

Not really, sure he misled, that's what he was paid to do. His articles tell you -- they tax all consumption as defined by NIPA. Kotlikoff never said it was a simple personal retail sales tax -- that was Boortz, remember?

But the same people who paid Boortz, also paid Kotlikoff. That's right, both were paid by same folks. Pretty cool trick, huh?

Kotlikoff even listed the various parts of consumption -- if you can find that document, which most people can not. And you would have to ignore everything you THOUGHT you know about Fairtax.

Is it Kotlikoff's fault you didn't find his document and read page 666 -667? It it his fault you thought Fairtax Book was on the level?

KOTLIKOFF and others told you -- cleverly, in 300 words out of 2 million words -- about these huge other taxes.

______________________________________________________

UNTAX THE POOR FRAUD....